Why are Personal Income Taxes Going Up

- Income taxes to increase to 15.25% this year and 15.5% in 07'

- A 6% GST is a welcome start, but more tax relief needed

- Program spending up 5.3% this year and 4.1% in '07

- Nothing to lower gas taxes or abolish the gun registry

Ottawa: The Canadian Taxpayers Federation (CTF) reacts to the 2006/07 federal budget, which was tabled in the House of Commons by Finance Minister Jim Flaherty this afternoon.

Tax Relief for Canadians

"The bottom line for average taxpayers is a net benefit in 2006 and larger tax savings in 2007. Yet the federal government's lowest personal income tax rate will rise. In 2005 it was set at 15 per cent and applied to the first $35,595 of income. The Conservative's first budget will see this rate increase to 15.25 per cent this year and to 15.5 per cent in 2007," said CTF federal director John Williamson. "So while the GST is being cut by one point, income taxes paid by ordinary Canadians will go up."

"The one group that will benefit immensely from this budget is Canadian households with young children," noted Williamson. "Economically, they will rocket ahead thanks to the government's fulfilment of its promise to provide all families with $100 a month for each child under age 6."

Federal Finance Department briefing documents prepared for Finance Minister Flaherty state that Canada's "personal and corporate income tax burden are the highest among the G7 countries."

"Budget 2006 does take steps to reduce a series of regressive corporate taxes, particularly on small and medium businesses," said Mr. Williamson. "The measures include immediately abolishing Ottawa's capital tax, eliminating the corporate surtax in '08, and reducing the general business tax rate to 19 per cent from 21 per cent by 2010. Yet this government should have moved to bring down personal income taxes. This will need to be the top priority for the 2007 Budget."

Gas Taxes

In August, 2005, then-Opposition leader Stephen Harper blasted the Liberal government for refusing to reduce gas taxes as prices soared. "There is no reason for the federal government to profiteer when consumers are hurting," he said urging the previous Liberal government to give motorists a break. "This is causing considerable dislocation. There are a lot of people on fixed incomes. There are a lot of businesses on thin margins that are going to be affected by this."

"The price of gasoline has skyrocketed. Last week the national average price was over $1.00 per litre," noted Williamson. "Despite the Prime Minister's promises to reduce gas taxes, there is nothing in the budget to accomplish this goal. This is a disappointment."

The Debt & Surplus Picture

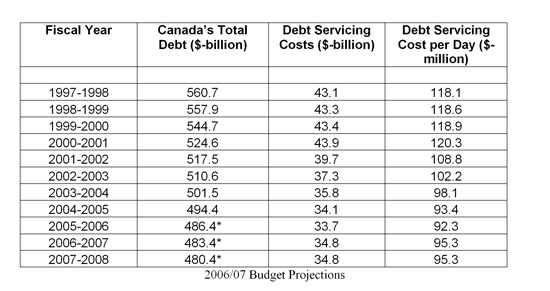

"We are pleased Minister Flaherty will reduce Canada's monster debt by $8-billion last year and another $3-billion this year," Williamson stressed. "Unfortunately the government will not implement a legislated debt reduction schedule. Debt servicing will chew up $35-billion this year, which amounts to $95-million each day. Ottawa should set yearly debt reduction targets as was done with the deficit and make those targets the law."

Overall Size of Government to Increase due to Modest Spending Growth

"Ottawa's program spending growth will increase by 5.3 per cent this fiscal year to $189-billion, and another 4.1 per cent in 2007 topping out at $196-billion," said Williamson. "If the government is capable of reducing spending in its non-priority areas and holding growth in others, the Conservatives will be able to offer broadly-based income tax relief in next year's budget."

What About Eliminating the Gun Registry

In 1995, Canadians were told by Ottawa that the federal gun registry would cost $2-million and there would be no substantial cost to taxpayers due to registration fees. In 2003, the Auditor-General stopped an audit due to incomplete information and predicted the registry would cost taxpayers $1-billion. The price of registry is on track to exceed $2-billion.

"The Harper government needs to abolish the gun registry," concluded Williamson. "If it does not have the necessary votes in the House of Commons to do so, it should cut off the program's annual funding allowance and starve it instead. "

-30-

For more information, contact John Williamson at 1-888-236-8490.